Non-Fungible Tokens

Seven decades ago, one could only hazily imagine the world of space; limited by their time’s technology, they would never have considered exploring space; but, to their surprise, Neil Armstrong stepped foot on the moon a decade later. The ability to connect with friends and other people across thousands of miles of Earth was only a dream or a short scene in the Simpsons two decades ago; but today, our technology allows us to explore the world via the internet and connect with people from all over the world. If the pattern isn’t clear, we are evolving. Today, evolution is taking place, changing our daily lives from the real world to the online world, and this evolution is scarcely seen by the human eye.

For many, the word Non-Fungible Tokens (NFTs) goes in one ear and out the other, but for others, it remains their only thought. With the recent birth of NFTs, many people began to wonder why someone would spend millions of dollars on pixels. The NFT market space may seem advanced to a beginner, though there are three main reasons people buy an NFT: social status, collections, and profit. But, before we get into the reasons for NFT purchases, it’s essential to first define “Non-Fungible Tokens.” To go word by word, “fungible” is the “[ability] to replace or be replaced by another identical item” (Webster’s Dictionary), or somewhat interchangeable. For example, if I hand someone $100 and they give me five $20 bills, there is no money loss on either side, revealing such an interaction is fungible. However, if I give someone $100 and they give me five $10 bills, someone is losing, so this interaction is not fungible or non-fungible. This is the case for NFTs: no matter how similar two NFTs may look in appearance or have the same price, they are not interchangeable; and if one were to trade their NFT with another, one side of the exchange would be at a loss of money, appearance, among other factors. Finally, the term “token” refers to a digital certificate that is stored on the blockchain for verification purposes. Thus, whenever someone buys an NFT, their wallet ID (which is used to distinguish your wallet from others) is stored on the blockchain (which is used to record transactions) and cannot be changed or erased.

Cryptocurrencies

Alongside the introduction of NFTs is the rise of cryptocurrencies such as Bitcoin and Ethereum, where, it is displayed in Figure 1, Bitcoin’s popularity exponentially increased from its beginning to now: where it increased from nearly zero wallet addresses in 2012 to about 25,000,000 in 2018. Since 2009, a revolutionary new way of making payments has existed. The invention of Bitcoin, the world’s first decentralized peer-to-peer payment system, spawned a new and burgeoning set of payment services known as cryptocurrencies. Cryptocurrencies are primarily decentralized forms of currencies, such as the US dollar, but on the internet. Bitcoin was created in 2009 in response to the financial crisis of 2008 by an unknown creator, who goes by the name of Satoshi Nakamoto.

Satoshi Nakamoto created Bitcoin to replace the traditional dollar, chiefly because he believed that Bitcoin was seen as superior to the traditional dollar because of its decentralized system, which means that no one person or entity controls the fluency and/or value of bitcoin, and every Bitcoin owner has the same role as the other; in contrast to the traditional dollar, where banks and governments control almost everything about it, resulting in unfair control and economic crashes. However, Bitcoin had one main flaw, the ability to move money around was very costly. For someone to send an amount of Bitcoin to another person, it could cost more than the amount wanted to be shipped, which was frustrating to its users: leading to the creation of Ethereum by Vitalik Buterin in 2015. Ethereum was a decentralized cryptocurrency that used its own currency to reduce transaction fees and enable immutable, programmatic contracts and applications. Ethereum became the primary currency for purchasing NFTs due to its unique capabilities that Bitcoin lacked, including Ethereum’s unique blockchain.

Blockchain

There is no doubt that there will be speculation about the security of the blockchain since many people don’t trust technology as more viruses and hackers present themselves. With our technology now, it is nearly impossible to gain one hundred percent of someone’s trust, especially in regard to their money, and allow them to feel fully secure about placing their money on the blockchain. Having a fear of the blockchain is understandable considering the age of the blockchain, and the absurd amount of stolen bitcoin: such as the 2014 Mt. Gox hack, which lost approximately $22 billion of bitcoin at the time of writing. However, as our technology evolves, so will our security around the blockchain. A new security system is being implemented in response to the majority of hacks directed at the blockchain, demonstrating how the blockchain is learning from its errors. Even technological advancements that have been around for decades, such as cars, are still not perfect and far from it, but every step forward is a step forward: the same way how the blockchain and NFTs will continue to grow in every aspect for the betterment of humankind.

Why Does Someone Spend Millions on NFTs?

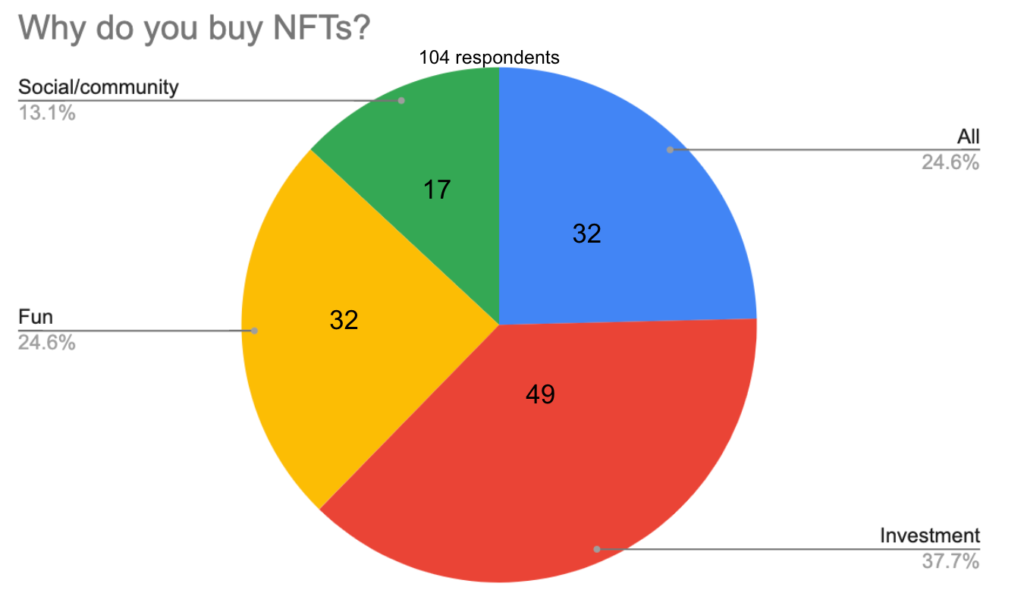

But the security of the blockchain won’t stop NFT lovers from continuing to purchase NFTs at absurd prices. As stated before, and displayed in Figure 2, the three main reasons for NFT purchases are social status (17 respondents), collections/fun (32 respondents), and profit/investments (49 respondents). Since the beginning of time, social ranks and classes have controlled our societies. They separate us and bring us together at the same time. One social rank system that has an effect on the NFT market is wealth: the wealthier are at the top and the poor are at the bottom.

For some, taking a screenshot of someone’s NFT satisfies their needs, the same as buying a fake designer product; however, for others, they want the real designer product and the real NFT. As the world turns into an online-based world, many wealthy people would like to expand their social rank from real life to the online world in order to satisfy their wants; this can be seen when people turn their online profile pictures into NFTs that they own to increase their social status.

The simpler reason for NFTs’ rise is collections. Like Pokémon cards, rocks, or quarters, some people enjoy collecting NFTs to satisfy their wants. Most collectors don’t purchase the most expensive NFTs, but they have numerous amount of NFTs that they hold on to since they find pleasure in them.

Although there are many collectors who collect for enjoyment, some people collect NFTs to make a profit. Lastly, the most basic reason for someone to purchase an NFT is to make some side money. This is not just the case for NFTs, it can be seen everywhere: whether in stocks, real estate, or regular commodities. Many influencers and companies, such as Logan Paul, Jimmy Donaldson (MrBeast), Gary Vaynerchuk, Adidas, and Nike, have taken an interest in profiting from and collecting NFTs and using their immense influential space, they have had a significant impact on the growth of NFTs towards their communities.

Excessive price of NFTs

Although NFTs have been newly introduced into our world, their prices soared to the top of the charts. NFTs date back to the early 2010s, when various artists, like Mike Winkelmann, popularly known as Beeple, began to produce digital art that is now worth millions of dollars. One of Beeple’s most astonished NFT sold for $69 million via Christie’s at an online auction, seen in Figure 3, making him wealthier than most physical painters, some of whom have worked in museums. But that’s not all, a simple screenshot of the first Twitter post from the CEO of Twitter, at the time, Jack Dorsey, sold for around $2 million.

The average price for an NFT draws people away from the idea of owning an NFT and the prices are unlikely to be changed. The fundamental supply-demand pattern is to blame for such a high price; because NFTs are relatively new to the market, few artists have enough NFTs to meet the requirements of their consumers, thus driving the prices up. One of the most renowned NFT projects, Bored Ape Club, the consumer could pay costs of around eight-five ETH (≈$170000). Plenty of critics say the unreasonable prices will be the main explanation for NFTs’ downfall since not many people would be able to purchase the art inflicting it to lose popularity. However, this is often not the case in many NFT lovers’ eyes; they see the NFT market booming until the ensuing generation’s technology outdoes ours (just like how paintings are being replaced by NFTs by our generation) because the high prices increase the popularity, causing NFTs to be seen by many others who may become NFT lovers. This confidence comes from the power to relate the NFT market and merchandise to designer products whose products are also at incomparable prices: including Supreme and Gucci. If people are willing to pay hundreds on a jersey simply because it says ‘Supreme’ or ‘Gucci,’ people are going to be willing to spend hundreds on digital art, some that have a deeper meaning than what meets the eye (women’s rights movement: World of Women and Crypto Queens).

Importance of NFTs

Nevertheless, NFTs would just be pictures if they didn’t have any significance. So what is their significance anyway? With the blockchain’s ability to track every transaction through cryptocurrencies and NFTs, we are able to authenticate these pieces of artwork faster than ever. This is groundbreaking since it is merely impossible for a human to detect whether an artwork is authentic one hundred percent of the time; which causes an estimated 20% of all artwork in museums to be a fraud. Additionally, many artists, digital and physical, inquire about a percentage of the price for which their artwork has been sold, usually 10%, known as a royalty. However, when a physical artwork is sold, it is difficult to track the purchase and many small artists will lose the royalty which they deserve. But this is not the case for NFTs since everything is tracked on the blockchain, so royalties are automatically sent, and it is easy for artists to track their artwork within the NFT marketspace; allowing artists a nearly 100% guarantee that they will receive their royalties upon purchase. All-around, cryptocurrencies and NFTs are new to our society and won’t be fully accepted and trusted by our world for most of their near life; however, they will change our daily lives, in the virtual world and physical world, and will continue to grow and reach new limits.

References

https://coinmarketcap.com/nft/

https://www.theverge.com/22310188/nft-explainer-what-is-blockchain-crypto-art-faq

https://www.forbes.com/advisor/investing/cryptocurrency/nft-non-fungible-token/

https://www.makeuseof.com/most-expensive-nfts-why-they-cost-so-much/

https://www.theverge.com/2021/3/11/22325054/beeple-christies-nft-sale-cost-everydays-69-milli on

https://andrewsteinwold.substack.com/p/-nft-survey-results-96-respondents?s=r